44 ytm and coupon rate

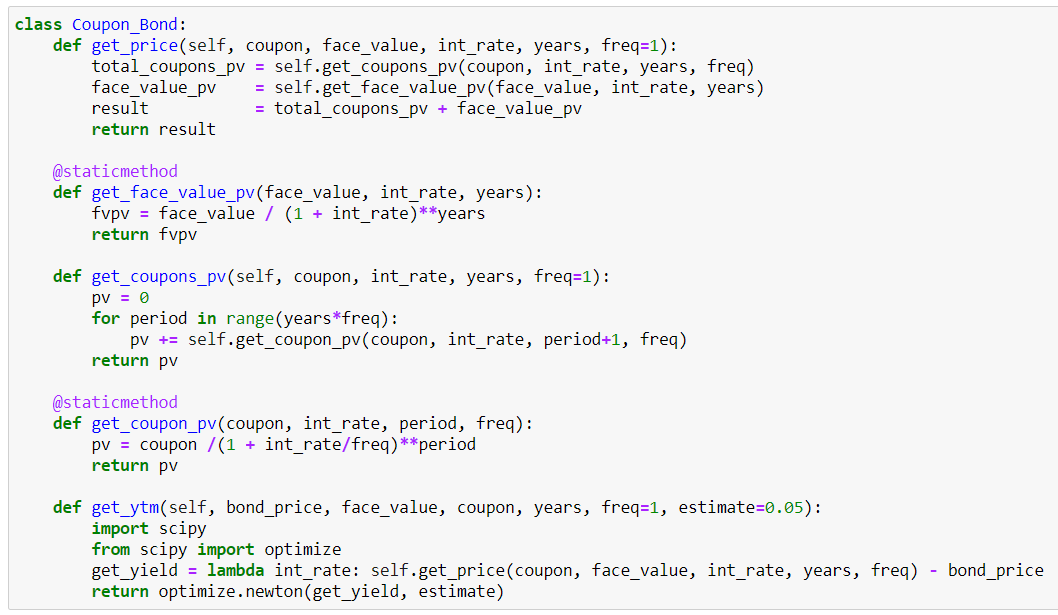

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a ... Yield to Maturity (YTM) - Overview, Formula, and Importance 07.05.2022 · Yield to Maturity (YTM) – otherwise referred to as redemption or book yield – is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and …

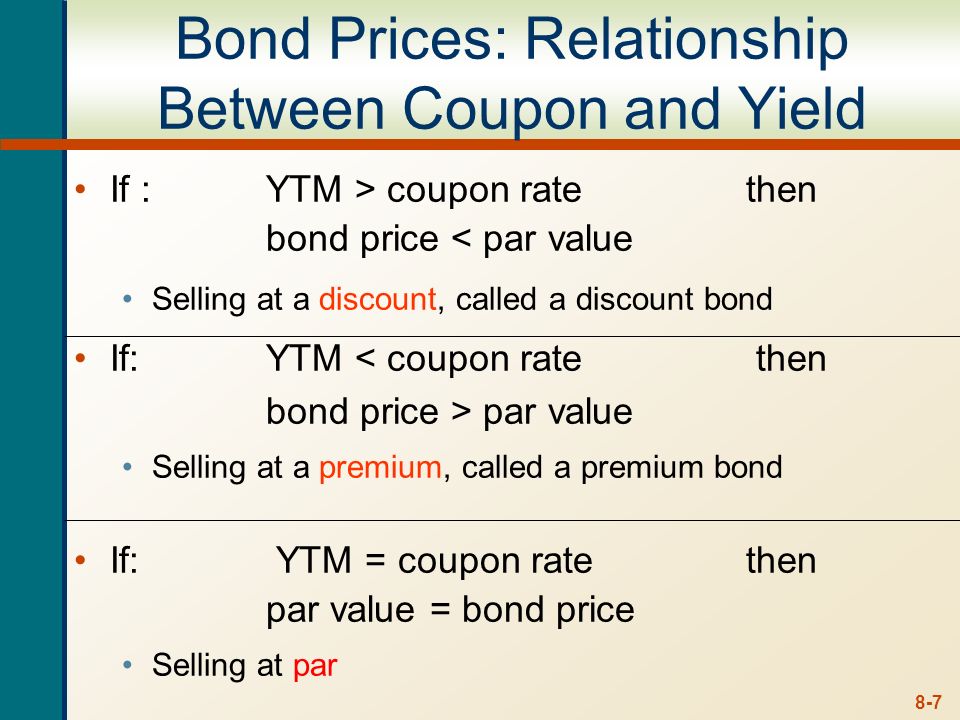

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Ytm and coupon rate

Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield To Maturity And Coupon Rate - bizimkonak.com Yield to Maturity (YTM) - Overview, Formula, and … CODES (8 days ago) On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. Difference Between YTM and Coupon rates Nevertheless, the term 'coupon' is still used, even though the physical object is no longer implemented. Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2.

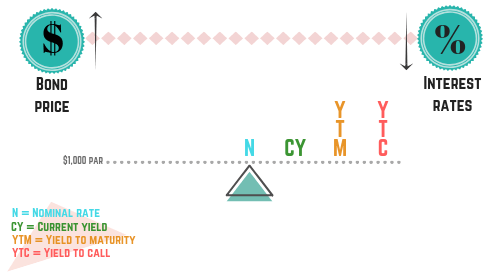

Ytm and coupon rate. Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Difference between YTM and Coupon Rates The formula for calculating YTM is as follows: YTM = [ (C/P) (1/n)]- [ (1+ (C/P))^ (-nYTM)] in which C equals annual coupon payments, P equals the price of the bond, n equals a number of compounding periods per year, and t equals a number of years until maturity. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Yield to Maturity Calculator | YTM | InvestingAnswers 25.09.2022 · "8" as the annual coupon rate "5" as the years to maturity "2" as the coupon payments per year, and "900" as the current bond price. Note: This YTM calculator assumes that the bond is not called prior to maturity. If the bond you're analyzing is callable, use our Yield to Call calculator to determine the bond’s value.

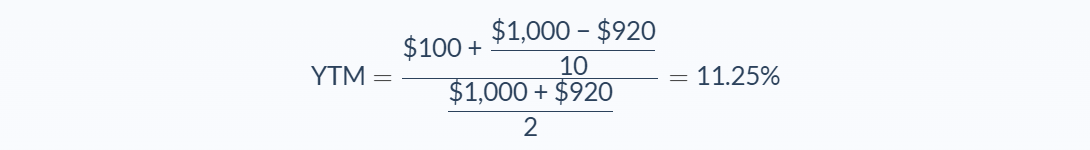

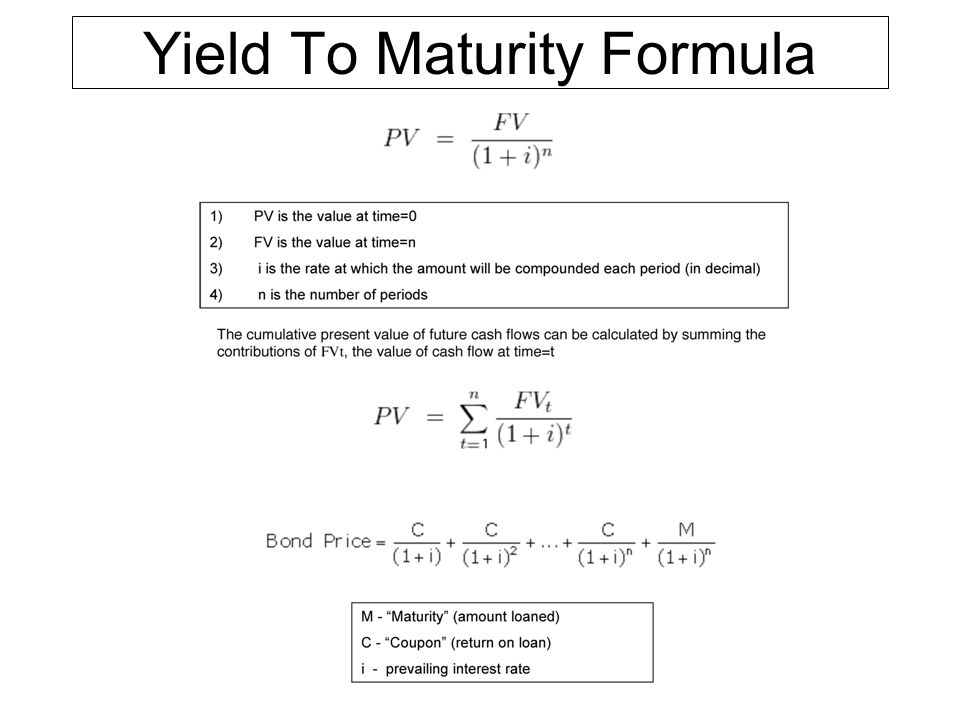

Coupon Rate - Meaning, Calculation and Importance - Scripbox YTM is the internal rate of return (IRR) of a bond investment. However, the assumption is that the investor holds the bond to maturity, and all the coupon payments are reinvested at the same rate. Yield to Maturity (YTM) = { (C) + [ (FV - PV) ÷ t]} ÷ [ (FV + PV) ÷ 2] Where, C - Coupon Payment FV - Face value of the bond Current Yield vs. Yield to Maturity: What's the Difference? A bond's yield is measured in different ways. Two common yields that investors look at are current yield and yield to maturity. Current yield is a snapshot of the bond's annual rate of return, while yield to maturity looks at the bond over its term from the date of purchase. 1. Yield to Maturity Calculator | Calculate YTM Jul 14, 2022 · Calculate the YTM; The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: cf - Cash flows, i.e., coupons or the ... Relationships among a Bond's Price, Coupon Rate, Maturity ... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM ...

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Yield to Maturity (YTM) is the expected return on a bond if held till maturity. Learn how to Calculate and its importance. Search Login ... the interest rate or YTM will be higher than the coupon rate. Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 40/(1+YTM)^3+ 1000/(1+YTM)^3 ... Yield to Maturity (YTM): Formula and Bond Calculator - Wall Street Prep An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value. How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made ... Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Understanding the Yield to Maturity (YTM) Formula | SoFi Example of YTM Calculation. Here's an example of how to use the YTM formula. Suppose there's a bond with a market price of $800, a face value of $1,000, and a coupon value of $150. The bond will reach maturity in 10 years, with a coupon rate of about 14%. By using this formula, the estimated yield to maturity would calculate as follows:

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples The coupon rate is 7.5% on the bond. Based on this information, you are required to calculate the approximate yield to maturity on the bond. Solution: Use the below-given data for the calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually.

Current yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows. = = $ % $ = $ $ = % Shortcomings of current yield. The current yield refers only to the yield of the bond at the current moment.

Yield to Maturity (YTM): Formula, Meaning & Calculation - ET … Annual Coupon Rate: 6%: Annual Interest ₹60: Time to Maturity: 8 years: Current Market Value ₹600 : Based on the above information, and using the YTM Formula mentioned earlier, the new YTM of Bond X is: YTM = [60 + {(1000 – 600) / 10}] / [(1000 + 600) / 2] = 13.8%. So, now, 2 years after its issue, the new YTM of Bond X is 13.8% instead of the earlier 7.4%. This is how …

Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded.

Yield to Maturity (YTM) - Meaning, Formula and Examples - Groww Here YTM will be higher than the coupon rate, which is 8%. If the bond is selling for a higher price than the face value, this means the interest rate in the market is lower than the coupon rate. This indicates that the YTM is lesser than the coupon rate. Current Yield

Difference Between YTM and Coupon rates | Investing Post The coupon rate, or, more simply stated, coupon of a particular bond, is the amount of interest paid every year. It is expressed as a percentage of the face value. Basically, it is the rate of interest that a bond issuer, or debtor, will pay to the holder of the bond. Thus, the coupon rate determines the income that will be earned from the bond ...

What is the difference between the YTM and the coupon rate? The coupon rate is the interest rate on the bond at the time of issue. The YTM or Yield to Maturity is the yield based on the current price of the bond. For example, if a $1000 bond maturing in 10 years is issued at 5%, then 5% is the coupon rate, which means it will always pay $50 per year until maturity.

Difference between Coupon Rate And Yield To Maturity Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond).

Coupon Rate Calculator | Bond Coupon 15.07.2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond …

Calculating Cost of Debt: YTM and Debt-Rating Approach The YTM will be the rate at which the present value of all cash flows = $1,050. $$\$1,050 = \left ( \sum_ {t=1}^ {20} \frac {\$40} { (1+i)^ {t}} \right)+\frac {\$1000} { (1+i)^ {20}}$$ We can use a financial calculator to solve for i. In this case, i = 3.643%, which is the six-month yield. The annualized yield will be 7.286%.

Coupon Rate Formula | Step by Step Calculation (with Examples) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will increase because an investor will be willing to purchase the bond at a higher value. A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula.

Yield to Maturity Formula - Crunch Numbers Difference between YTM and the Coupon Rate . A coupon rate is an interest paid to the bondholder who receives it every year from the bond's issue date until it matures. YTM > Coupon Rate; The current YTM rate is higher than the bond coupon rate ⇒ the bond is selling at a discount.

When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

YTM AND ITS INVERSE RELATION WITH MARKET PRICE | India - The Fixed Income Example 1 (YTM calculation): YTM on a bond with a face value of ₹100, market price of ₹110, annual coupon rate of 7.5% paid semi-annually, term to maturity of 9 years, will be 6.085%

Difference Between YTM and Coupon rates Nevertheless, the term 'coupon' is still used, even though the physical object is no longer implemented. Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2.

Yield To Maturity And Coupon Rate - bizimkonak.com Yield to Maturity (YTM) - Overview, Formula, and … CODES (8 days ago) On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years.

Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "44 ytm and coupon rate"