42 coupon rate on bonds

Press Releases | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Bonds and Securities. Buy, Manage, and Redeem ... Interest rate statistics; Guide to Fixed Income: Types and How to Invest - Investopedia Aug 31, 2022 · Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals and at reasonably predictable levels. Fixed-income investments can be used to ...

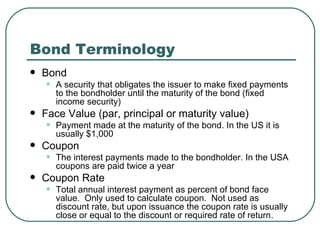

Bond (finance) - Wikipedia The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR).

Coupon rate on bonds

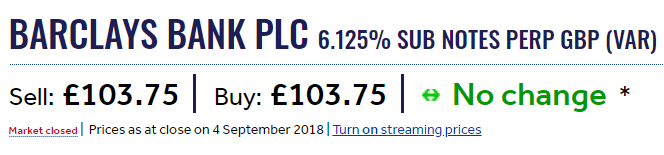

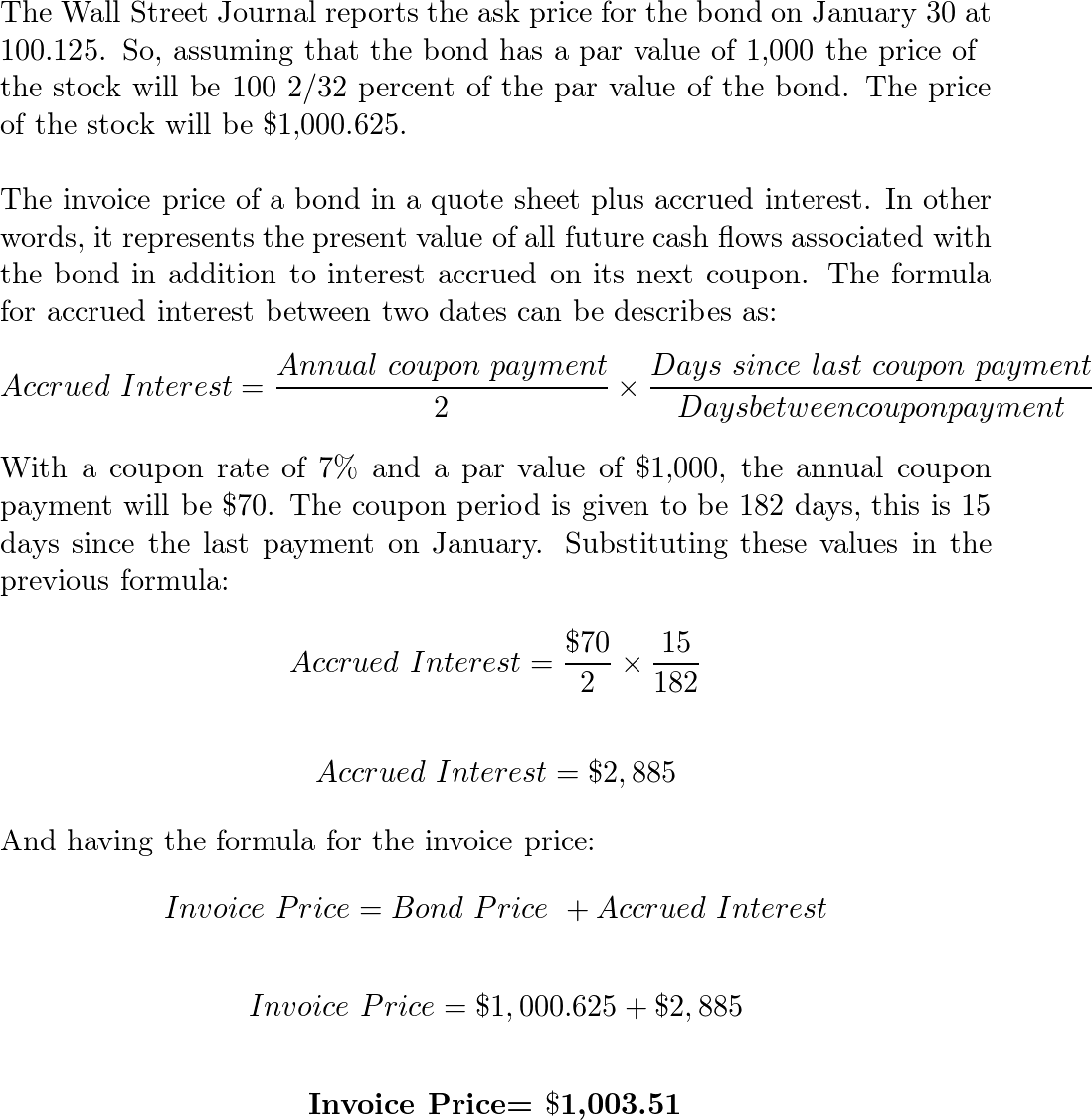

Bonds & Rates - WSJ Bonds & Rates News. Yield Curve Inversion Reaches New Extremes. A Lack of Bond Buyers Pushes Mortgage Rates Higher. Easing Inflation Ignites Bond-Market Rally. View More. Other Bonds & Rates Data. How To Find Coupon Rate Of A Bond On Financial Calculator How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Coupon rate on bonds. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... 4 Basic Things to Know About Bonds - Investopedia Oct 24, 2022 · The coupon is also called the coupon rate or nominal yield. To calculate the coupon rate, divide the annual payments by the face value of the bond. To calculate the coupon rate, divide the annual ... MSN MSN Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Coupon Bond: Definition, How They Work, Example, and Use Today Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. What is Coupon Rate? (Formula + Calculator) - Wall Street Prep Coupon Rate = Annual Coupon ÷ Par Value of Bond. For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon ... United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EST) GB3:GOV . 3 Month . 0.00: 4.22: 4.32% +27 +430: 12:19 AM:

Colombia Girds for Bond Coupon Shock to Cut Refinancing Risk The country raised $2 billion by selling 2032 bonds in April 2021, which were priced to yield 3.356%. Demand totaled $4.2 billion, or 2.6 times the amount offered, the ministry said. Fitch Ratings ... What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

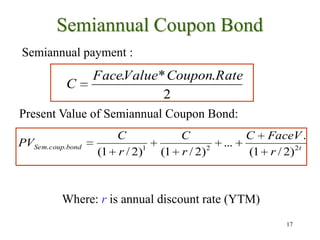

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

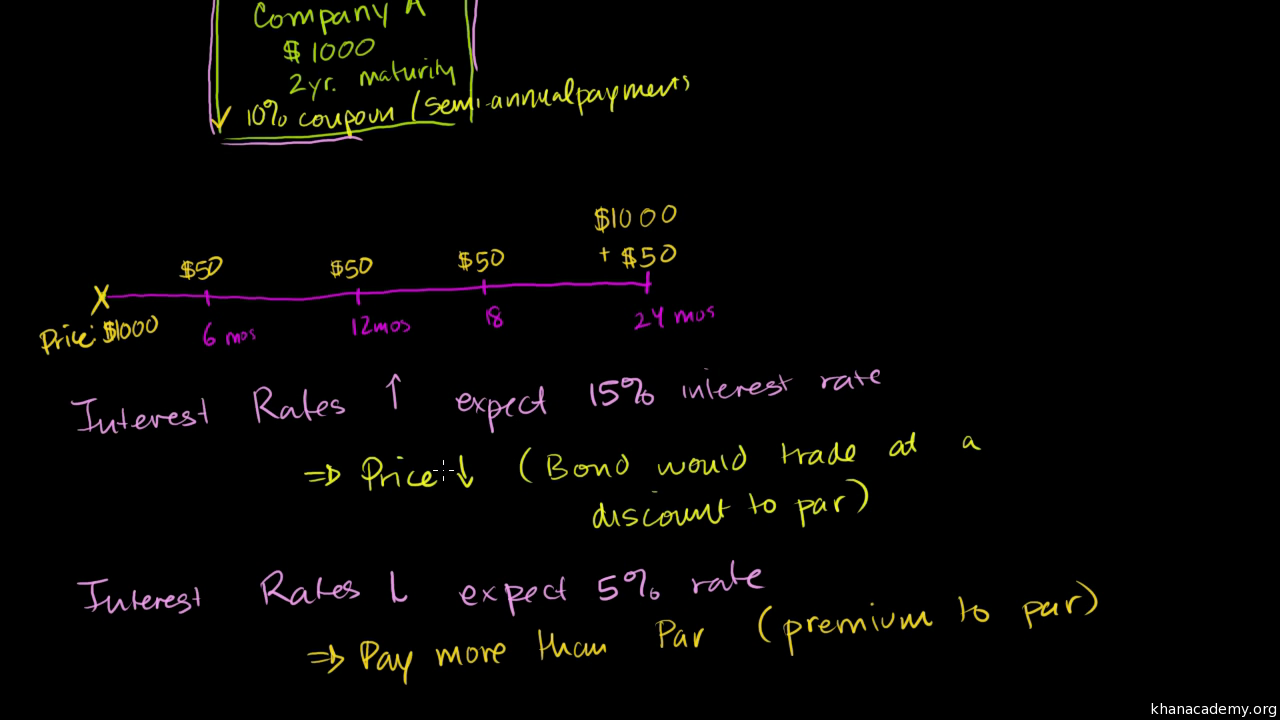

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... In secondary markets, bonds may be sold for a premium or discount on their face value. Therefore, although you might've ...

Terminal Bond Coupon Rate for 2023-24? : r/bonds Terminal Bond Coupon Rate for 2023-24? Hello Fine Bond Peoples. What do you think the terminal rate for bond yields will be in the next coming years? comments sorted by Best Top New Controversial Q&A Add a Comment . More posts you may like.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

SBI raises Rs 10,000 crore from maiden infrastructure bonds The amount raised through bonds will be utilised in enhancing long-term resources for funding infrastructure and the affordable housing segment. The tenor of these bonds is 10 years. ... Based on the response, the bank has decided to accept Rs 10,000 crore at a coupon rate of 7.51 percent payable annually for a tenor of 10 years. This ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ...

What is a Coupon Rate? - Definition | Meaning | Example Other bonds may pay interest every three months. In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

What Is the Coupon Rate of a Bond? - The Balance The coupon rate of a bond or other fixed income security is the interest rate paid out on the bond. When the government or a company issues a bond, the rate is fixed. The coupon rate is stated as an annual percentage rate based on the bond's par, or face value. The dollar amount represented by this coupon rate is paid each year—usually on a ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

How To Find Coupon Rate Of A Bond On Financial Calculator How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year.

Bonds & Rates - WSJ Bonds & Rates News. Yield Curve Inversion Reaches New Extremes. A Lack of Bond Buyers Pushes Mortgage Rates Higher. Easing Inflation Ignites Bond-Market Rally. View More. Other Bonds & Rates Data.

Post a Comment for "42 coupon rate on bonds"