44 zero coupon bonds formula

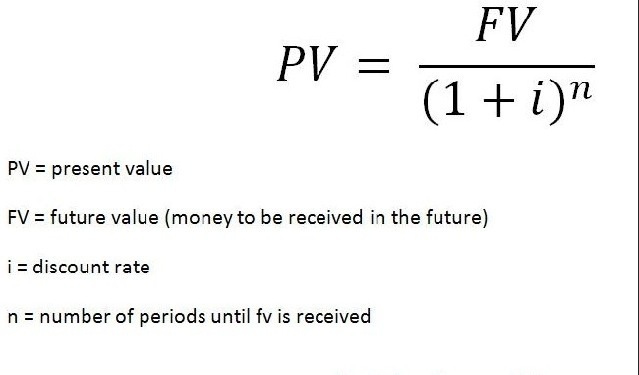

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Zero Coupon Bond Value Formula - Crunch Numbers It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity. Example of price of a zero-coupon bond calculation Let's assume an investor wants to make 10% of return on a bond.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Zero coupon bonds formula

Zero Coupon Bond - Explained - The Business Professor, LLC Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay: $10,000 / (1 + 0.04)^2 = $9,245. Zero-Coupon Bond - Definition, How It Works, Formula Formula for calculating zero-coupon bond yield. Yield is the quantum of returns, usually expressed in percentage, that an investment earns over some time. The yield to maturity (YTM), also called the 'book yield' or 'redemption yield' is the rate of return an investor earns by holding the bond up to its maturity date. Let's illustrate this ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Formula; Example; Zero-Coupon Bond vs. Regular Coupon Bearing Bond; Advantages; Disadvantages; Recommended Articles; Explanation. These Bonds are initially sold at a price below the par value at a significant discount, and that's why the name Pure Discount Bonds referred to above is also used for these Bonds.

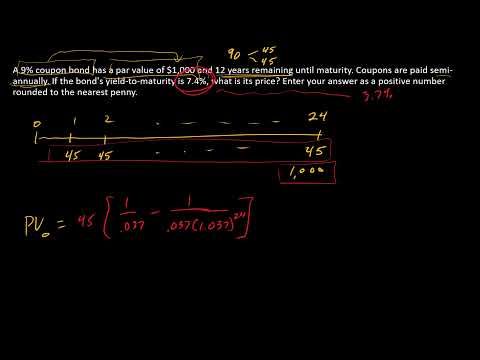

Zero coupon bonds formula. Zero-Coupon Bond: Definition, Formula, Example etc. Zero-Coupon bond also known as an accrual bond, and the word coupon represents interest. Pricing Formula of Zero - Coupon Bonds: Pricing of bond is important to determine how much amount an investor will be paid at the time of purchasing the bonds. As Zero-Coupon bond purchases with a discount, hence it is important, how much discount to be ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator Zero-Coupon Bond Value Formula M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

What Is a Zero-Coupon Bond? - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until maturity... What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... The formula for Zero-Coupon Bonds. The price of zero-coupon bonds is calculated using the formula given below: See also Why Would a Company Buy Back Its Own Stock? All Factors You Should Know. Price = M / (1 + r) ^ n, where. M = maturity value of the bond. (In other words, the face value of the bond) Zero Coupon Bond Value - Formula (with Calculator) - finance formulas After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero Coupon Bond Calculator - What is the Market Value? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000 Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com = $55,317 − $50,000 = $5,317 This gain of $5,317 is made up of the unwinding of discount (the increase in present value as it nears maturity) plus capital gain portion that results from positive movement in market yield on the bond. The value of zero-coupon bond will continue to increase till it reach $100,000 at the time of its maturity. Zero Coupon Bond: Formula & Examples - Study.com In order to calculate the ytm of zero-coupon bond, assuming a yearly discount rate, the following zero-coupon bond formula is used: P V = M /(1+i)n P V = M / ( 1 + i) n Where: PV is the... How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Formula We can calculate the Present value by using the below-mentioned formula: Zero-Coupon Bond Value =Maturity Value/ (1+i)^ Number of Years You are free to use this image on your website, templates, etc, Please provide us with an attribution link Example Let's understand the concept of this Bond with the help of an example:

Zero-Coupon Bonds: Characteristics and Calculation Example If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Formula; Example; Zero-Coupon Bond vs. Regular Coupon Bearing Bond; Advantages; Disadvantages; Recommended Articles; Explanation. These Bonds are initially sold at a price below the par value at a significant discount, and that's why the name Pure Discount Bonds referred to above is also used for these Bonds.

Zero-Coupon Bond - Definition, How It Works, Formula Formula for calculating zero-coupon bond yield. Yield is the quantum of returns, usually expressed in percentage, that an investment earns over some time. The yield to maturity (YTM), also called the 'book yield' or 'redemption yield' is the rate of return an investor earns by holding the bond up to its maturity date. Let's illustrate this ...

Zero Coupon Bond - Explained - The Business Professor, LLC Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay: $10,000 / (1 + 0.04)^2 = $9,245.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "44 zero coupon bonds formula"