41 zero coupon bond price calculation

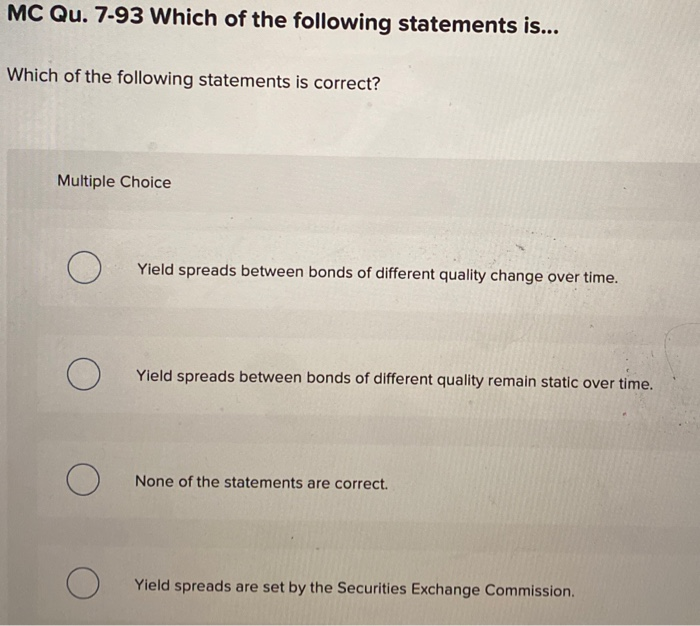

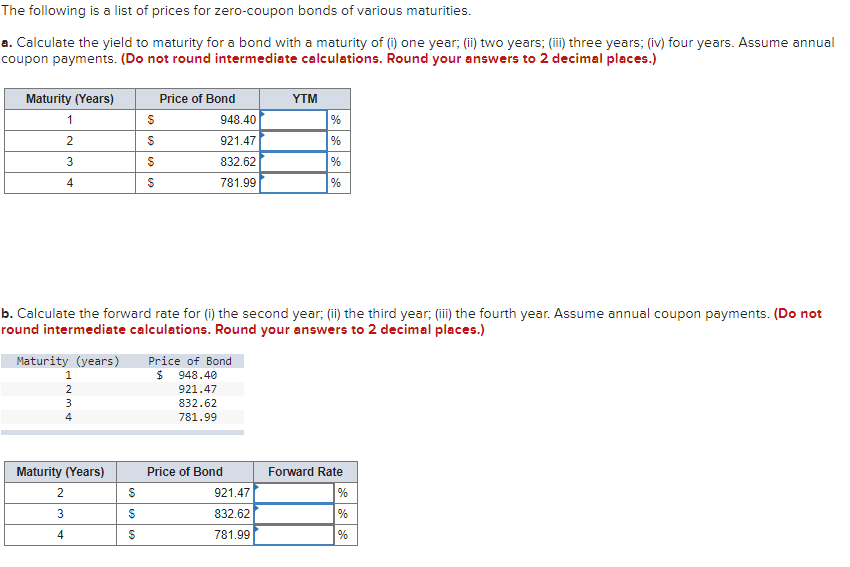

Zero coupon swap - Wikipedia A ZCS takes its name from a zero coupon bond which has no interim coupon payments and only a single payment at maturity. A ZCS, unlike an IRS, also only has a single payment date on each leg at the maturity of the trade. The calculation methodology for determining payments is, as a result, slightly more complicated than for IRSs. Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

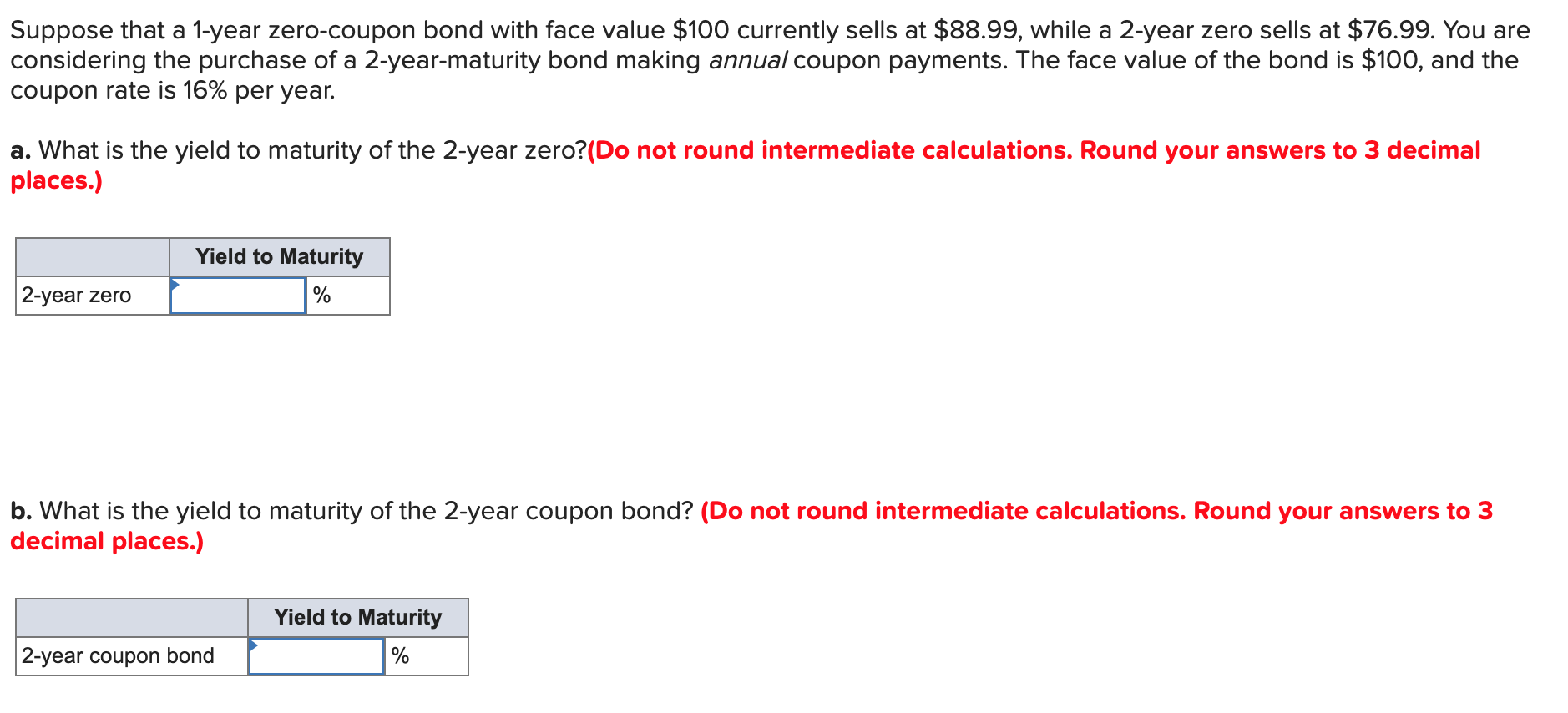

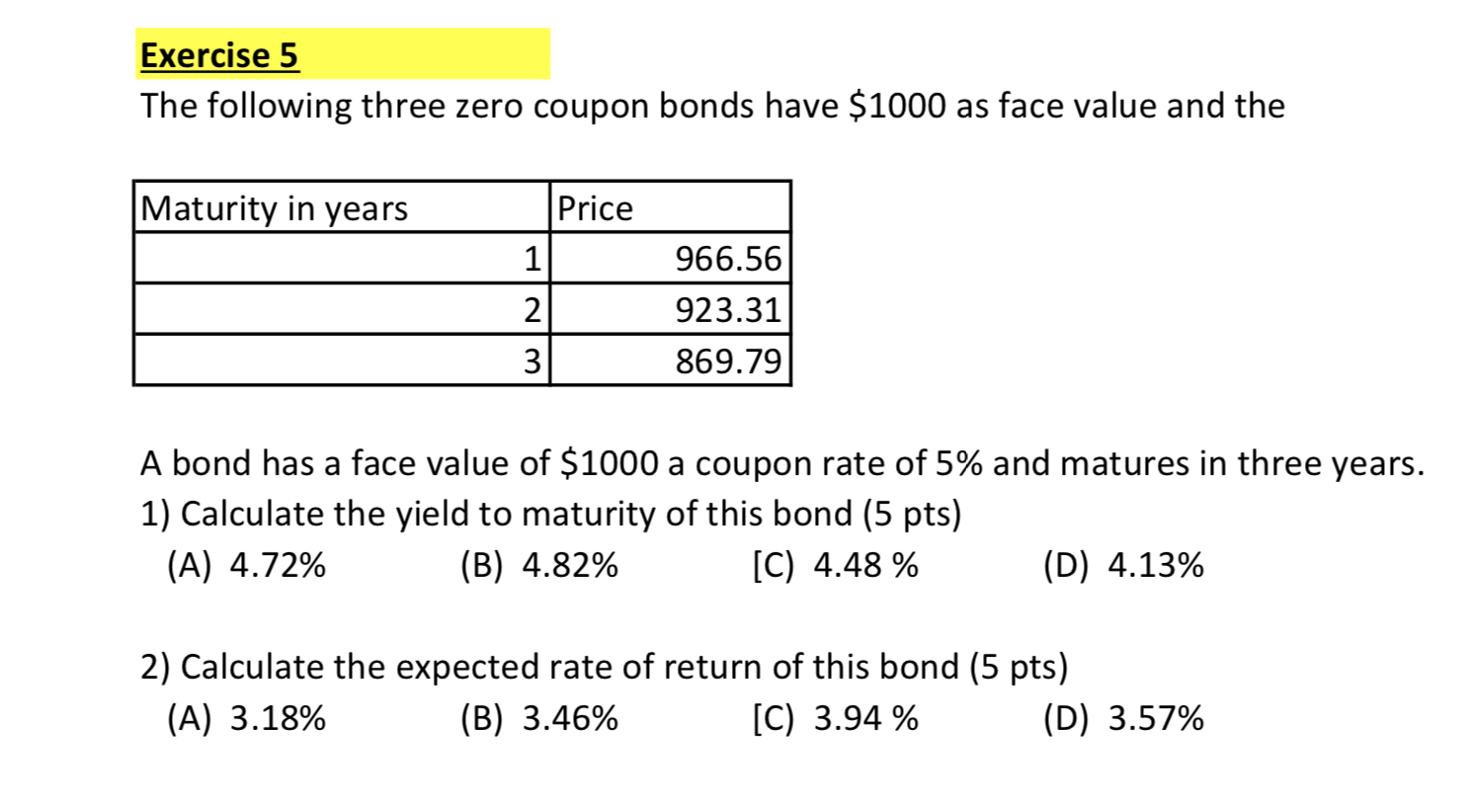

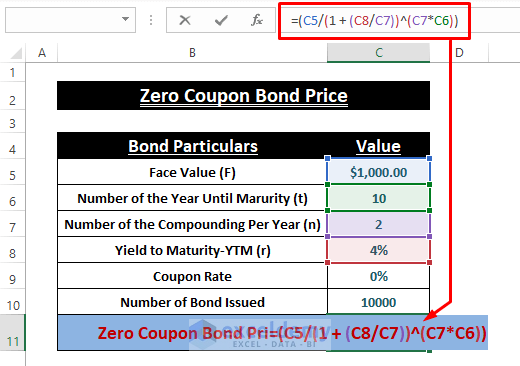

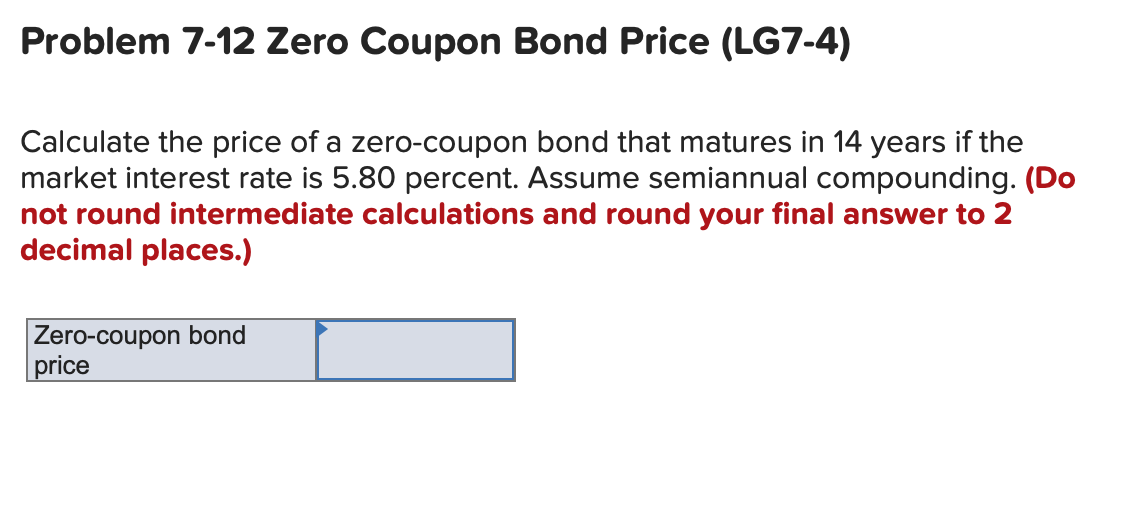

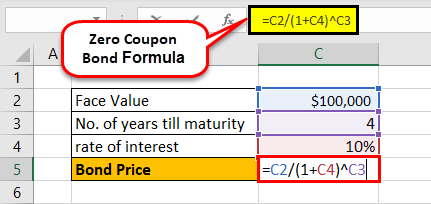

Zero Coupon Bond Calculator – What is the Market Price ... P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Zero coupon bond price calculation

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond duration - Wikipedia Consider first a $100 investment in each, which makes sense for the three bonds (the coupon bond, the annuity, the zero-coupon bond - it does not make sense for the interest rate swap for which there is no initial investment). Modified duration is a useful measure to compare interest rate sensitivity across the three. Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Zero coupon bond price calculation. Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Price Example Calculation. In our illustrative scenario, let’s say that you’re considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions. Face Value (FV) = $1,000; Number of Years to Maturity = 10 Years; Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0% Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... Bond duration - Wikipedia Consider first a $100 investment in each, which makes sense for the three bonds (the coupon bond, the annuity, the zero-coupon bond - it does not make sense for the interest rate swap for which there is no initial investment). Modified duration is a useful measure to compare interest rate sensitivity across the three.

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 zero coupon bond price calculation"