39 coupon rate bond formula

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Coupon Rate: Formula and Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

Coupon Rate vs Interest Rate | Top 8 Best Differences What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income …

Coupon rate bond formula

Bond Yield: Formula and Calculator (Step-by-Step) - Wall Street … Bond Coupon Rate Formula. The coupon rate can be calculated by dividing the annual coupon payment by the bond’s par value. Coupon Rate = Coupon / Bond Par Value; For example, given a $1,000 par value and bondholder entitled to … Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Coupon Rate Formula | Simple-Accounting.org For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable for investors than those with lower coupon rates. Bond Yield Rate vs. Coupon Rate: An Overview. Even if the bond price rises or falls in value, the interest ...

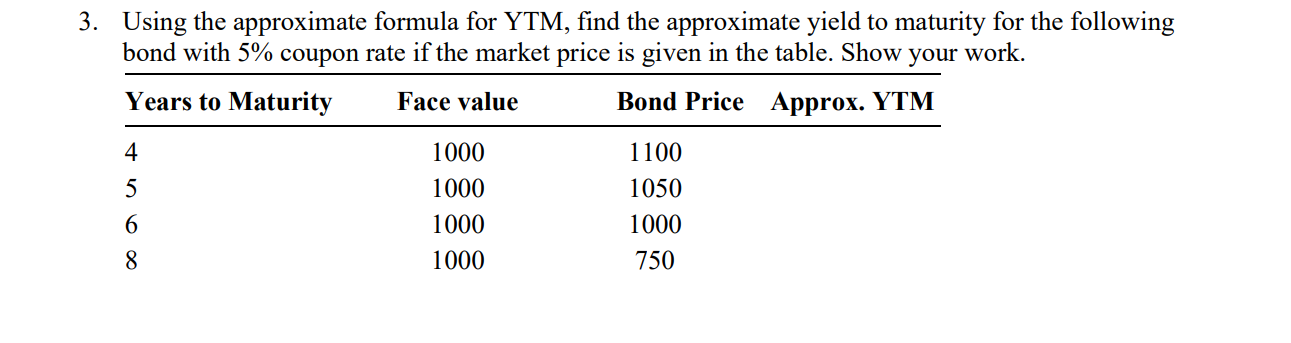

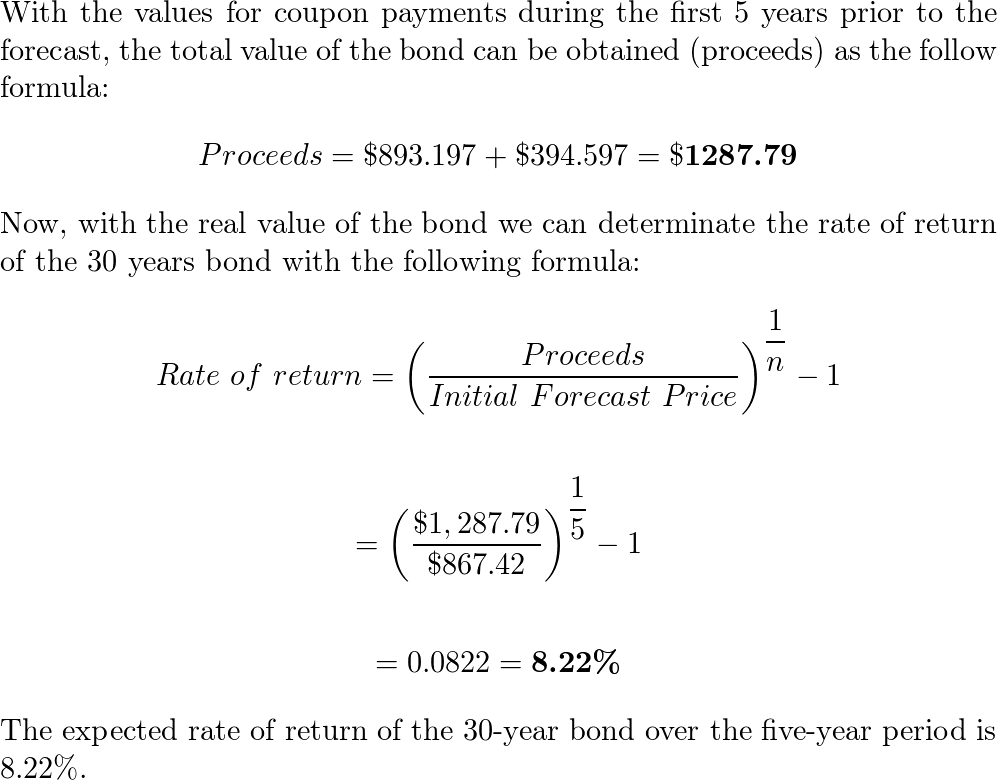

Coupon rate bond formula. Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Coupon Rate Formula For Bonds - Verified Oct 2022 Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo. WebFormula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Jul 01, 2021 - lyf.monis-hundeschule-pferdetraining.de Jul 01, 2021 · Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity.There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [ (Face Value / Current Value) (1 / time periods)] -1. The yield to maturity formula for a ....

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Coupon Rate Formula & Calculation - Study.com Coupon Rate Formula. To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

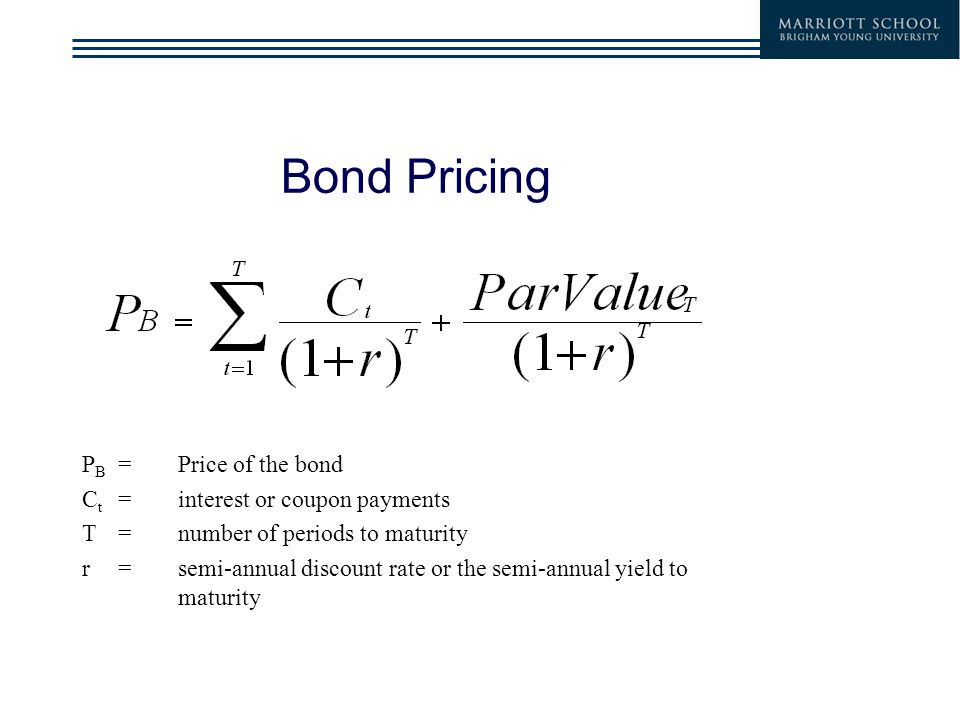

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value... Zero Coupon Bond Calculator - Calculator Academy Jan 05, 2022 · where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a profit at maturity when the bond is redeemed for its face value. Zero Coupon Bond Example

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

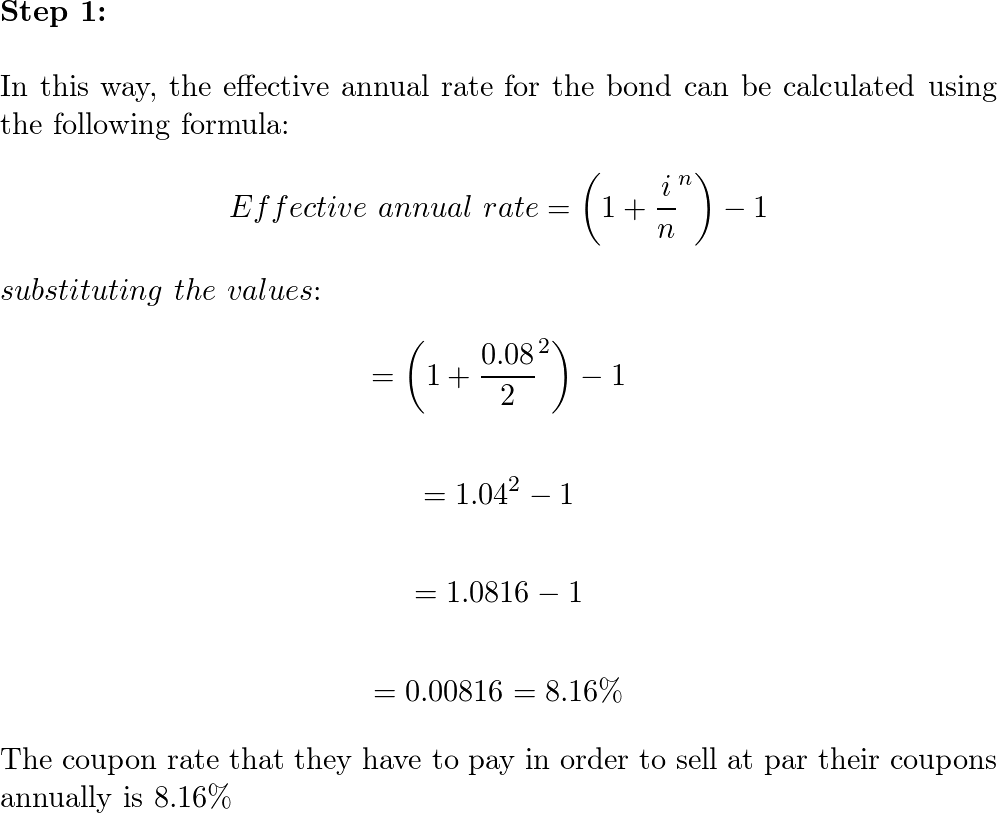

Real Interest Rate Formula | Calculator (Examples With Excel … Real Interest Rate = 4% – 2%; Real Interest Rate = 2% Therefore, the real interest is expected to be 1.96% and 2% according to full and approximate formula respectively.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a...

Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples. Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and ...

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Bond Formula | How to Calculate a Bond | Examples with Excel Template Mathematically, the formula for coupon bond is represented as, Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity

How to Calculate Bond Price in Excel (4 Simple Ways) The typical Coupon Bond Price formula is. 🔄 Coupon Bond Price Calculation ... Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. =(C5/(1 + (C8/C7))^(C7*C6))

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond's face value with the coupon rate. Table of contents What is Bond Yield Formula? Calculate Bond Yield

Coupon Rate Formula | Simple-Accounting.org For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable for investors than those with lower coupon rates. Bond Yield Rate vs. Coupon Rate: An Overview. Even if the bond price rises or falls in value, the interest ...

Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Bond Yield: Formula and Calculator (Step-by-Step) - Wall Street … Bond Coupon Rate Formula. The coupon rate can be calculated by dividing the annual coupon payment by the bond’s par value. Coupon Rate = Coupon / Bond Par Value; For example, given a $1,000 par value and bondholder entitled to …

Post a Comment for "39 coupon rate bond formula"