44 how to calculate zero coupon bond

How to Calculate the Price of a Bond With Semiannual Coupon … Web24.4.2019 · Calculating the price of a bond with semiannual coupon payments involves some higher mathematics. Essentially, you'll have to discount future cash flows back to present values. To determine if the bond is a good value, compare the return of the bond with competitive issues in the marketplace. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … WebCalculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

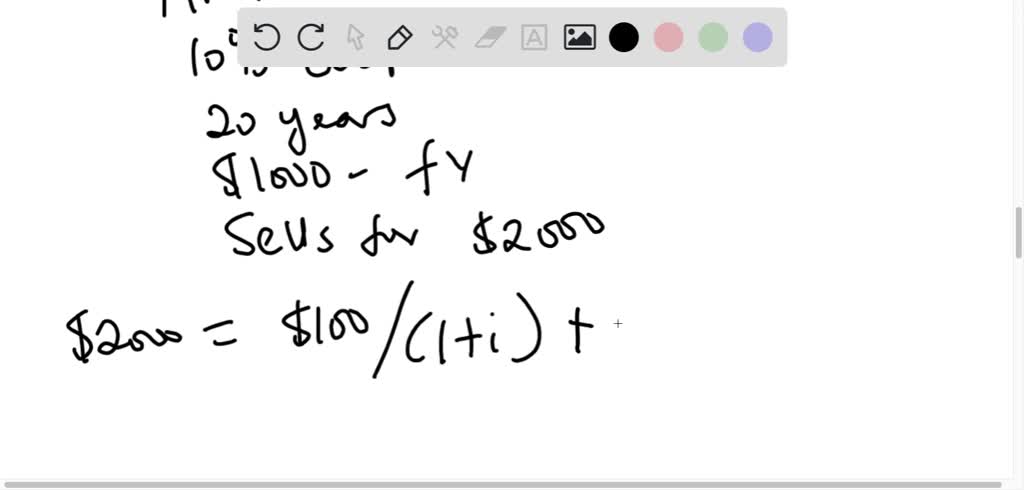

How to Calculate PV of a Different Bond Type With Excel - Investopedia Web20.2.2022 · A. Zero Coupon Bonds Let's say we have a zero coupon bond (a bond which does not deliver any coupon payment during the life of the bond but sells at a discount from the par value) maturing in 20 ...

How to calculate zero coupon bond

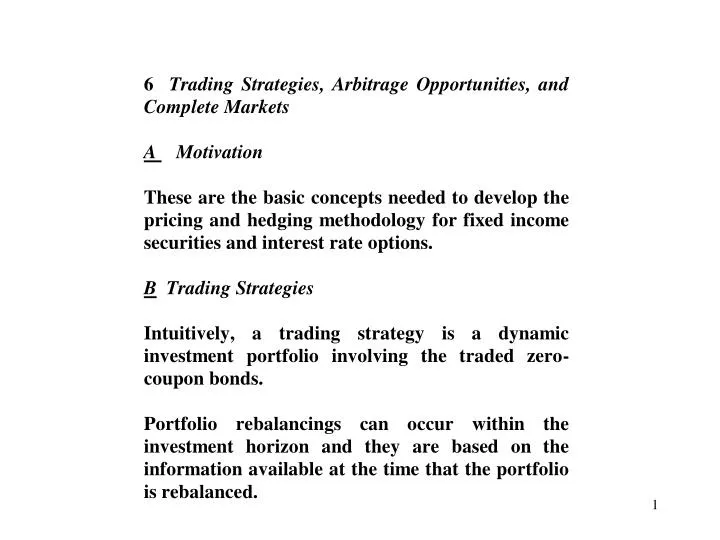

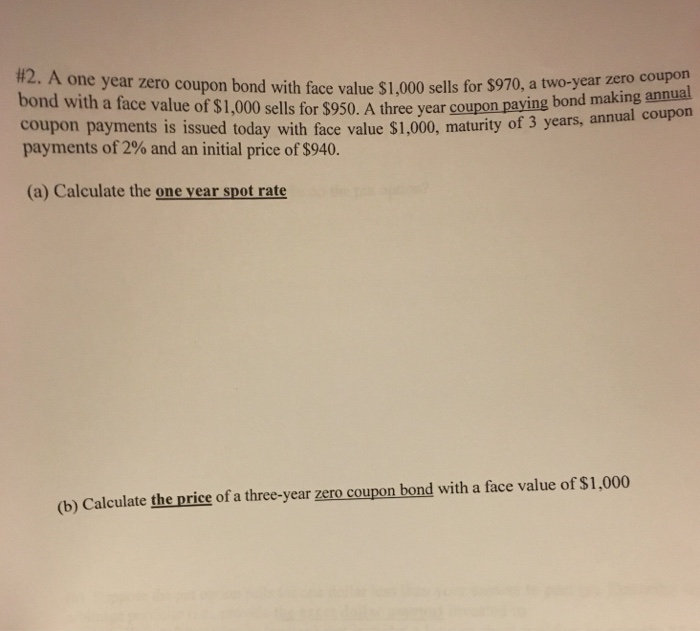

Calculate Price of Bond using Spot Rates | CFA Level 1 Web27.9.2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ... Zero-Coupon Bond Definition - Investopedia Web31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond Pricing Formula | How to Calculate Bond Price? | Examples WebSince the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

How to calculate zero coupon bond. Zero-Coupon Bond - Definition, How It Works, Formula Web28.1.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to … 14.3 Accounting for Zero-Coupon Bonds – Financial Accounting WebExplain how interest is earned on a zero-coupon bond. Understand the method of arriving at an effective interest rate for a bond. Calculate the price of a zero-coupon bond and list the variables that affect this computation. Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term “compounding.” Zero Coupon Bond (Definition, Formula, Examples, Calculations) Web= $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount … How to calculate bond price in Excel? - ExtendOffice WebCalculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price of this zero coupon bond as follows:

Bond Pricing Formula | How to Calculate Bond Price? | Examples WebSince the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. Zero-Coupon Bond Definition - Investopedia Web31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Calculate Price of Bond using Spot Rates | CFA Level 1 Web27.9.2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ...

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

Post a Comment for "44 how to calculate zero coupon bond"