44 yield to maturity of zero coupon bond

Zero Coupon Bond Calculator - MiniWebtool About Zero Coupon Bond Calculator . The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. Yield to Maturity | Formula, Examples, Conclusion, Calculator Apr 12, 2022 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding.

Chapter 6-Math Flashcards - Quizlet If an Allied Chemical zero coupon bond due in 12 years is selling for $420.00, what is its yield to maturity? a. 7.50% b. 4.64% c. 6.51% d. 5.26% a. 7.50% A General Electric 7½25 bond closed at 98. What is the current yield? a. 7.65% b. 7.81% c. 7.50% d. 7.34% a. 7.65% Penny Pincher Discount Grocers has an 11s 22 bond that closed at 102 3/8.

Yield to maturity of zero coupon bond

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

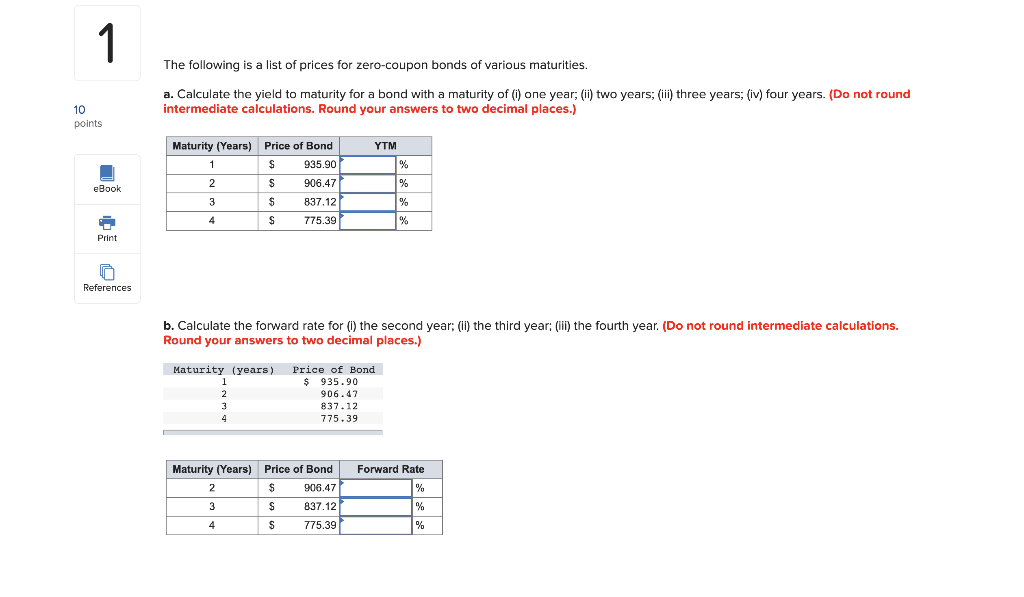

Yield to maturity of zero coupon bond. QUANTITATIVE PROBLEM 2 What is the current yield to ... QUANTITATIVE PROBLEM 2 What is the current yield to maturity on the zero coupon bond that has a face amount (or par value) of $1,000 and the current market price for the bond is $850? The bond matures in 4 years. YIELDS TO MATURITY ON ZERO-COUPON RONDS - Bond Math Fourteen-year TIGRS are priced at $250 to yield 10.151% (s.a.). Such problems are easily solved using the time-value-of-money keys on a financial calculator or a spreadsheet program. In this chapter, I work with a 10-year zero-coupon corporate bond that is priced at 60 (percent of par value). Its yield to maturity is 5.174% (s.a.). Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. Bootstrapping | How to Construct a Zero Coupon Yield Curve in ... Now, for a zero-coupon with a maturity of 6 months, it will receive a single coupon equivalent to the bond yield Bond Yield The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price.

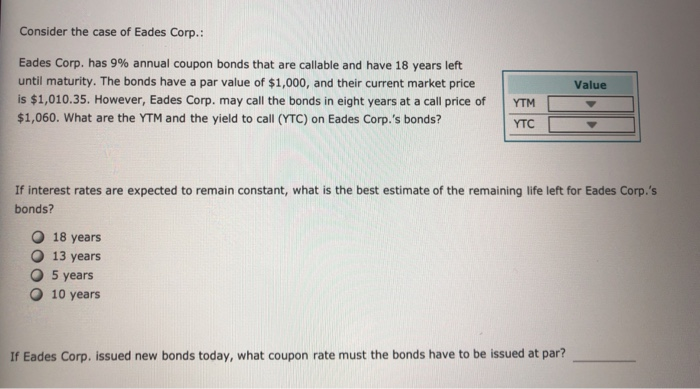

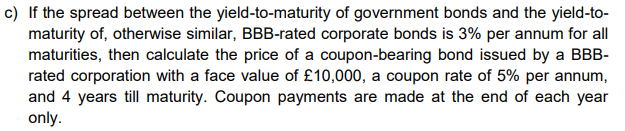

Finance Chapter 6 Flashcards - Quizlet A) The yield to maturity of a coupon bond is a weighted average of the yields on the zero-coupon bonds. B) If the zero-coupon yield curve is downward sloping, the yield to maturity will decrease with the coupon rate. C) The information in the zero-coupon yield curve is sufficient to price all other risk-free bonds. Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Yield to Maturity Calculator (YTM Calculator) - YTM Formula To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity. For example, if you purchased a $1,000 for $900. The interest is 8 percent, and it will mature in 12 years, we will plugin the variables.

Solved 15, A zero-coupon bond has a yield to maturity of 9 ... Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16. What Is a Zero Coupon Yield Curve? (with picture) The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ... Zero Coupon Bonds India- Invest in Zero Coupon Bonds A zero coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Yield to Maturity (YTM) Definition - investopedia.com Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. To calculate YTM here, the cash flows must be determined first. Every six months...

Calculating Yield to Maturity of a Zero-Coupon Bond ... Zero-Coupon Bond Formula. The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1. Zero-Coupon Bond YTM Example. Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could ...

Yield to Maturity (YTM) Definition & Example ... How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. The zero coupon bond formula is as follows: For instance, you want to invest in a $1,000 zero coupon bond that has three years until it matures. It's currently valued at $1,825.

Value and Yield of a Zero-Coupon Bond | Formula & Example Where yield is the periodic bond yield and n refers to the total compounding periods till maturity.. Yield on a Zero-Coupon Bond. Given the current price (or issue price) of a zero-coupon bond (denoted as P), its face value (also called maturity value) of FV and total number of n coupon payments, we can find out its yield to maturity using the following equation:

65 Calculate the yield to maturity of a zero coupon bond ... Calculate the yield to maturity of a zero coupon bond with a face value of $1000, maturing in 10 years and selling for a price of $529.30. a. 6.57% b. 8.45% c. 4.16% d. 10.23% e. 12.17% ANS: A Solve for i 1000 = 529.3 (1 + i) 10 i = (1000/529.3) 1/10 - 1 = .0657 a . 6.57 %

Yield to Maturity Calculator | Good Calculators You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate. It also calculates the current yield of a bond. Fill in the form below and click the "Calculate" button to see the results.

Post a Comment for "44 yield to maturity of zero coupon bond"